Money Managers

Ox Securities provides the technology for you to manage your clients’ funds.

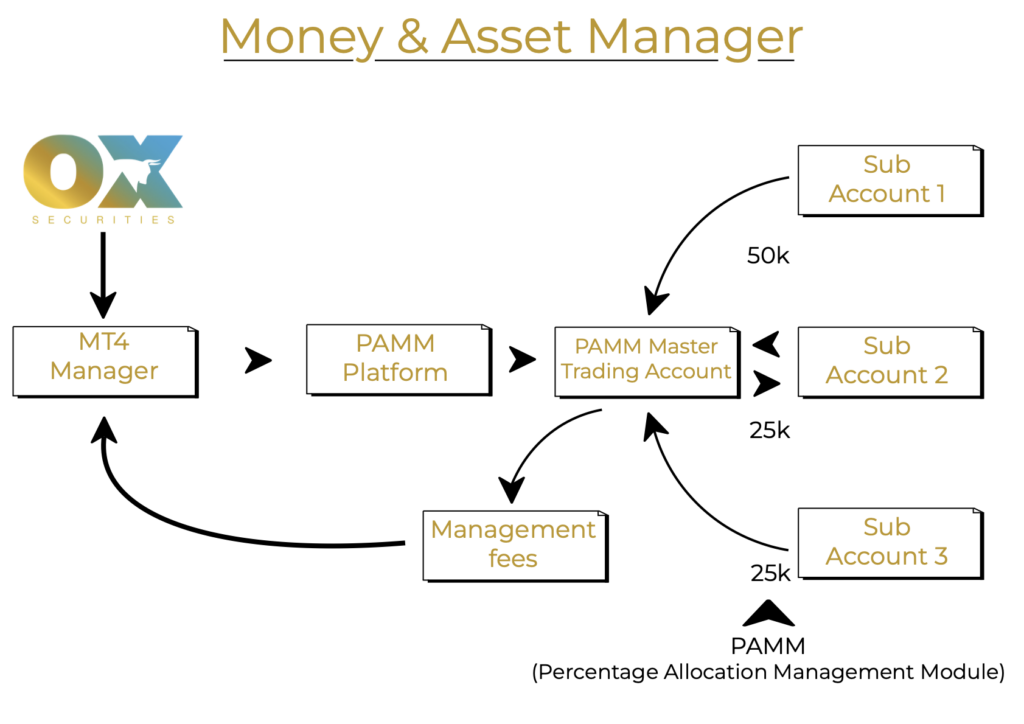

MAM, PAMM or Copy Trading

PAMM Master Orders are executed as the one trade/one ticket .

This means all accounts receive the same price fill, then the PAMM Software distributes the trade to the Slave/Subscriber Accounts based on the allocation method.

Money Manager Program

Central to Ox Securities’ services is the flexibility provided through both Multi Account Manager (MAM) and Percent Allocation Management Model (PAMM) options, among others.

With straight-through processing (STP), deep liquidity, and narrow spreads, Ox Securities enables money managers to fill large orders at their desired prices.

Our MAM and PAMM solutions empower managers with the control necessary to optimize their returns.

Please note: You must have the Master Login from your Money Manager in order access PAMM.

Key Features

- Numerous trade allocation methods including proportionate by equity, cash allocation, fixed lot etc

- Fully customisable trading conditions

- Quick and easy calculation of performance/management fees

- Comprehensive reporting for Money Managers & clients

- Rebates paid in real time

- Add and withdraw funds without affecting overall trading

- All trading types allowed including EA, scalping, discretionary etc.

Money Manager Responsibilities

Money Managers play a pivotal role in the investment decision-making process.

It’s important to note the distinctions between the accountabilities and responsibilities of a money manager, and those associated with utilizing the execution-only trading services provided by Ox Securities.

-

Investment Strategy Money Managers are accountable for formulating and implementing the investment strategy for the portfolios under management.

-

Asset Allocation Decisions related to asset allocation, including the selection of specific securities or assets within the portfolio.

-

HWM – Performance Fee Calculation The “high-water mark” is like the highest point your money has ever reached in an investment. It’s important because it affects how much a fund manager gets paid. Let’s say you invest with a fund manager, and your investment grows to $1,000. That’s the high-water mark. If your investment goes down to $800, the manager doesn’t get any performance fees until they make your investment go back up to at least $1,000. This rule makes sure the manager must do a good job before they get paid extra.

-

Risk Management Managing and mitigating risks associated with the investments for a portfolio is their primary responsibility.

-

Client Communication Keeping clients informed about the performance, strategy adjustments, and any relevant market developments is vital for maintaining trust and transparency.

On the other hand, when utilizing the execution-only trading services provided by Ox Securities, the primary accountability shifts towards the following:

-

Order Execution Our platform’s primary responsibility is to execute trade orders accurately and promptly as per your instructions.

-

Market Access We provide access to a wide range of financial markets and instruments, enabling you to execute your chosen investment strategies effectively.

-

Technical Support Our team is available to assist with any technical issues related to the trading platform, ensuring seamless execution.

-

Reporting We provide trade confirmations and statements to keep you informed about executed trades and account activity. It is the money manager’s duty to familiarize themselves with the PAMM Portal for generating their statements, as necessary. It’s important to emphasize that, while we facilitate the execution of trades, the ultimate investment decisions and portfolio management remain under the control of the money manager. To ensure a successful and mutually beneficial partnership, it’s imperative that both parties clearly understand and uphold their respective accountabilities and responsibilities.

Money Manager Program Benefits

OX Securities PAMM Investor Video Guide

PAMM Investor Video Guides

Partner with Ox. Get in touch today

- Dedicated partners specialist account manager

- 24/5 Multi Lingual Support

- Speak to the same person every time

- Tailored plans to help grow your business

- Skpe, Whatsapp & Telegram support available

- Integrity. Honesty. Transparency